Mantra DAO ($OM) takes decentralized finance’s (DeFi) innovation of financial networks were users’ voices are heard one step further- by incentivizing token holders to participate in the maintenance and activity of the platform. Mantra also solves the problem that most DeFi projects face — user inactivity. Apart from providing financial services, Mantra gives its users rewards for assisting in system development. But how is Mantra doing this?

Background

Mantra DAO’s council is composed of various crypto experts including John Patrick Mullin, Will Corkin, James Anderson, Rodrigo Quan Miranda, and Stephane Laurent Villedieu. They are experienced crypto developers with backgrounds in finance and entrepreneurship.

The project was developed to leverage the “knowledge and wisdom of the crowd” to create a fully-decentralized ecosystem. With an aim to give financial control back to the people, Mantra’s team decided to build a new financial protocol with community-governance functions.

What is Mantra DAO?

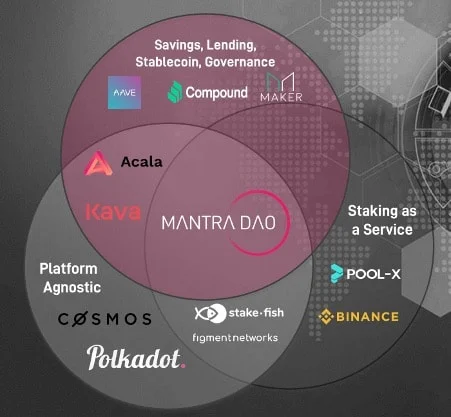

Mantra DAO is a Decentralized Autonomous Organization (DAO) built on the Parity Substrate for the Polkadot ecosystem, focused on staking and lending. It also features more community governance functions through its native $OM token.

The ecosystem supports the following features:

- Multi-asset staking and lending platform — Users can perform multiple types of transactions like savings, lending, and governance as Mantra DAO provides cross-chain access to other existing DeFi projects.

- Merit-based reward system – Through Mantra’s incentive system, users can gain rewards for actively using the platform.

- DAO – Through its native token, users can gain exclusive voting rights on important protocol decisions.

Rio Blockchain

The network is built on top of the Rio blockchain. And compared with other systems, Rio can process up to 3,000 transactions per second (tps) — a hundred times higher transaction throughput than Ethereum and Bitcoin combined.

RioChain is also an interoperable system, allowing various entities and dApps across various blockchains to interact with each other smoothly.

How does the DAO work?

Users are given the option to stake or lend their digital assets by depositing them on Mantra’s smart contracts. These assets are pooled and can be loaned to other users to power the platform’s lending service.

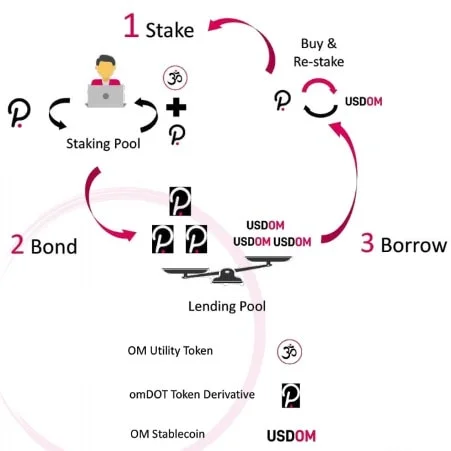

When users stake their assets, they gain interest fees and OM tokens in return. The following are Mantra’s primary services:

Staking and Lending – Users can stake tokens like Polkadot (DOT), supported DPoS assets, and OM. In return, they receive staking rewards in the form of OM tokens. Users have the option to collateralize their loans with OM as well.

Ownership and Governance – Holders of OM gain voting rights on Mantra’s DAO. This means that any important changes and parameters implemented in the platform are voted on by OM holders. These decisions can be anything from adjusting interest rates, level of inflation and grant allocations, among others.

Reputation – Mantra implements a reward system named the KARMA protocol. This is designed to recognize the contribution of OM token holders in the platform by way of providing reputation points.

The KARMA protocol

Karma is Mantra’s reputation mechanism that plays a vital role in the ecosystem by enabling the reward and incentivization of its users to execute certain activities. Users who perform various actions with the system are rewarded with KARMA.

The Karma Protocol has 10 tiers, each of them unlocks various perks that would allow users to enjoy extra incentives to increase their OM token, reduce fees, gain more rewards, etc.

Here are some of the network activities that can help OM holders gain Karma points:

- Staking their OM tokens, loaning from the platform, or loan repayments;

- Governance participation, such as voting on protocol proposals;

- Joining the Mantra pool; and

- Referrals

OM Token

The whole Mantra ecosystem is powered by the OM token. OM allows community members to influence the direction of the whole project, access collateralized loans and compounded interest, and join the Mantra pool.

When OM is used to enter the Mantra pool or pay for interest fees on their loans, that token is transferred to Mantra DAO’s burn wallet. This process is somehow different from the popular MakerDAO because the tokens are burned on a quarterly basis. The token burn will continue until eventually, a total of 50% of all the OM in supply is gone.

Staking OM

Mantra DAO has enabled a non-custodial staking service on the tokens DOT, KSM, and OM. In the future, other Polkadot supported tokens (RING, PCX, and ACA) and DPoS assets (XTZ, TRX, ADA, EOS, ELA) will also be made available.

Mantra distinguishes the staking of assets based on their chain and token type. DPoS assets are charged with a staking fee while Polkadot assets are not. These parameters, however, can be affected by the decision of the community in the near future.

What is being developed in the pipeline is Mantra’s plan to add custodial staking-as-a-service (SaaS) products on other PoS assets.

Borrowing in Mantra

Mantra is working on different lending services that follow three phases.

Phase 1 – Open Source Lending Protocol

Through Mantra’s composability, it will provide cross-chain access to other DeFi lending protocols. The purpose of this is to offer Mantra users the opportunity to earn from lending interest fees gained from ERC-20 assets.

Phase 2 – Third-Party Lending Service Providers

This will aim to provide access to high-interest savings options and stablecoin loans through partnerships with third-party lending service providers. All of these services will be made accessible on Mantra’s platform.

Phase 3 – Own Proprietary Lending Algorithm

In the future, Mantra will launch its own proprietary lending algorithm and stablecoin system which can be collateralized by multiple assets, even those that are on top of other chains. Through tokenized derivatives, users can generate staking rewards while applying for stablecoin loans.

Mantra Pool – Rewarding Savings

Mantra has developed a savings game, not only to incentivize staking but to give users the chance to share Mantra DAO’s staking rewards. Winners will be chosen weekly and they will be selected randomly from the participants.

To join the Mantra pool, users have to burn OM tokens. If they have enough Karma points, they can also be given automatic entries to the pool.

The funds assigned for the rewards in the Mantra pool comes from 25% of the staking rewards generated by Mantra DAO assets. The prize will be given as a basket of its native assets like Polkadot (DOT), Kusama (KSM), Tezos (XTZ), and OM. If they choose to convert these rewards to OM, they gain interest income on top.

Conclusion

Mantra DAO belongs to one of the many DeFi projects seeking to provide crypto users with better control over how their protocol runs. The problem with many other DAO projects is that while they have locked-up value in their smart contracts, voting participation is actually low.

Through Mantra’s incentive model for governance participation, there is a strong likelihood that the development of the protocol will be a result of its community’s decisions.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.