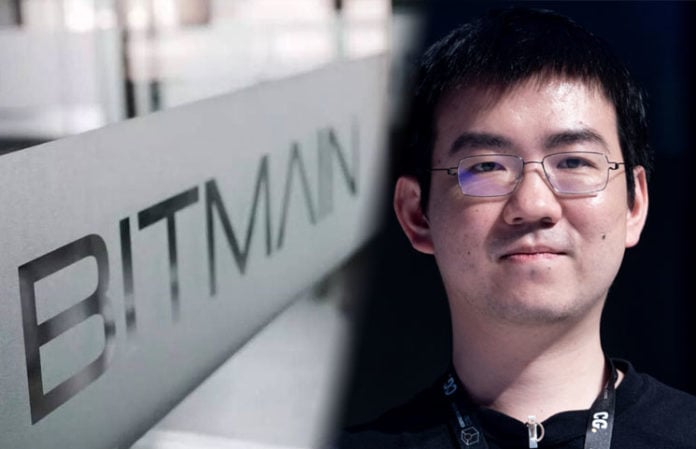

Recently reports have surfaced regarding trouble at Bitmain – with entire research divisions cut and rumors that CEO Jihan Wu will step down. The reason why this is important for the entire crypto field is for 2 reasons:

- Bitmain has a huge effect on the price of Bitcoin Cash and Litecoin – with holdings of up to $600M USD in Bitcoin Cash alone.

- Future of Mining – Bitmain the largest producer of mining equipment (ASICs)

Currently, Bitmain is trying to issue an IPO and raise additional funds. For many, a successful Bitmain IPO will mean good news for Bitcoin Cash, whilst a failed IPO would mean disaster. In this article, we will examine what is known about Bitmain.

Bitmain Holds 1 Million Bitcoin Cash (5% of supply)

Bitmain is responsible for mining and holding a significant amount of Bitcoin, Bitcoin Cash, Litecoin and DASH. It is difficult to track directly on the blockchain how much they own as they control newly minted coins. There is a leaked chart of Bitmain cryptocurrency holdings from the IPO filing in Q1 of 2018:

From what we can see from the chart, Bitmain was has been increasing their supply of Bitcoin Cash from 841,000 BCC (BCH) to 1,021,315 BCC over a 3 month period.

Mining Slowdown

Hong Kong Exchange hesitant to approve Bitmain IPO

Hong Kong Exchange (HKX)

Hong Kong’s Exchange (HKX) has been hesitant to approve

Bitmain has 6 months to gain regulatory approval from the HKEX and the Securities and Futures Commission (SFC) before the application is considered lapsed. Once the application has lapsed, the application decision needs to be appealed for Bitmain to have any chance of having an IPO.

Trouble for Bitcoin Cash?

With Bitmain in hot waters, Bitcoin Cash holders worry that this is bad news for their future. Bitmain has been the biggest vocal supporter and cryptocurrency buyer for Bitcoin Cash. With holdings of 1 Million Bitcoin cash, the own around 5% of the total supply. Bitmain also funds Bitcoin Cash development – and this is under jeopardy as there rumors that this research funding will be cut.